One of the best perks of the Marriott Bonvoy family of credit cards is the complimentary elite night credits you receive each year — ranging from 15 to 25 nights, depending on which card you have. And if you hold both a personal and a business credit card, you earn up to 40 elite night credits annually from your cards alone.

That’s quite the head start for elite status each year. Let’s discuss the value you get when you hold both a personal and small-business Marriott card.

Get 80% of the way to Platinum status and choice benefits

Since you can stack elite night credits, holding a personal and business Marriott card is worthwhile if you’re eligible. Some Marriott credit cards come with 15 elite nights annually — including the Marriott Bonvoy Boundless® Credit Card (see rates and fees). However, the Marriott Bonvoy Brilliant® American Express® Card offers 25 elite night credits per year.

You may wonder why this is relevant when several of the Marriott cards and The Platinum Card® from American Express also offer Gold Elite status (enrollment is required, terms apply) or the ability to earn higher status based on spending. The big difference is that this automatic status doesn’t grant you the corresponding number of elite nights — so you still need to reach the normal qualification thresholds if you want to enjoy the program’s Choice Benefits or hit even higher status tiers.

Related: The complete guide to earning Marriott elite status with credit cards

If you frequently stay at Marriott properties, you can stack these 15 to 25 elite night credits on top of your own travel to upgrade to the next elite tier faster.

When you stack credits between a business card and a personal card that comes with 15 elite night credits — like the Marriott Bonvoy Boundless and the Marriott Bonvoy Business® American Express® Card — you’ll have 30 elite night credits at the beginning of each year. Reaching Platinum Elite status requires 50 nights per year, meaning you’re already 60% of the way there. You would need to stay just 20 additional nights (or earn the nights through credit card spending on the Boundless card) to reach the next tier.

And once you’ve reached Platinum Elite status, the benefits can be incredibly valuable — including things like lounge access and Nightly Upgrade Awards.

Those with the Marriott Bonvoy Brilliant Amex receive complimentary Platinum Elite status each year as a perk of the card. This will entitle you to benefits like room upgrades and complimentary breakfast. However, you will not have the necessary credits (50 nights) to earn the annual choice benefit associated with Platinum status. This benefit allows you to choose from one of the following:

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

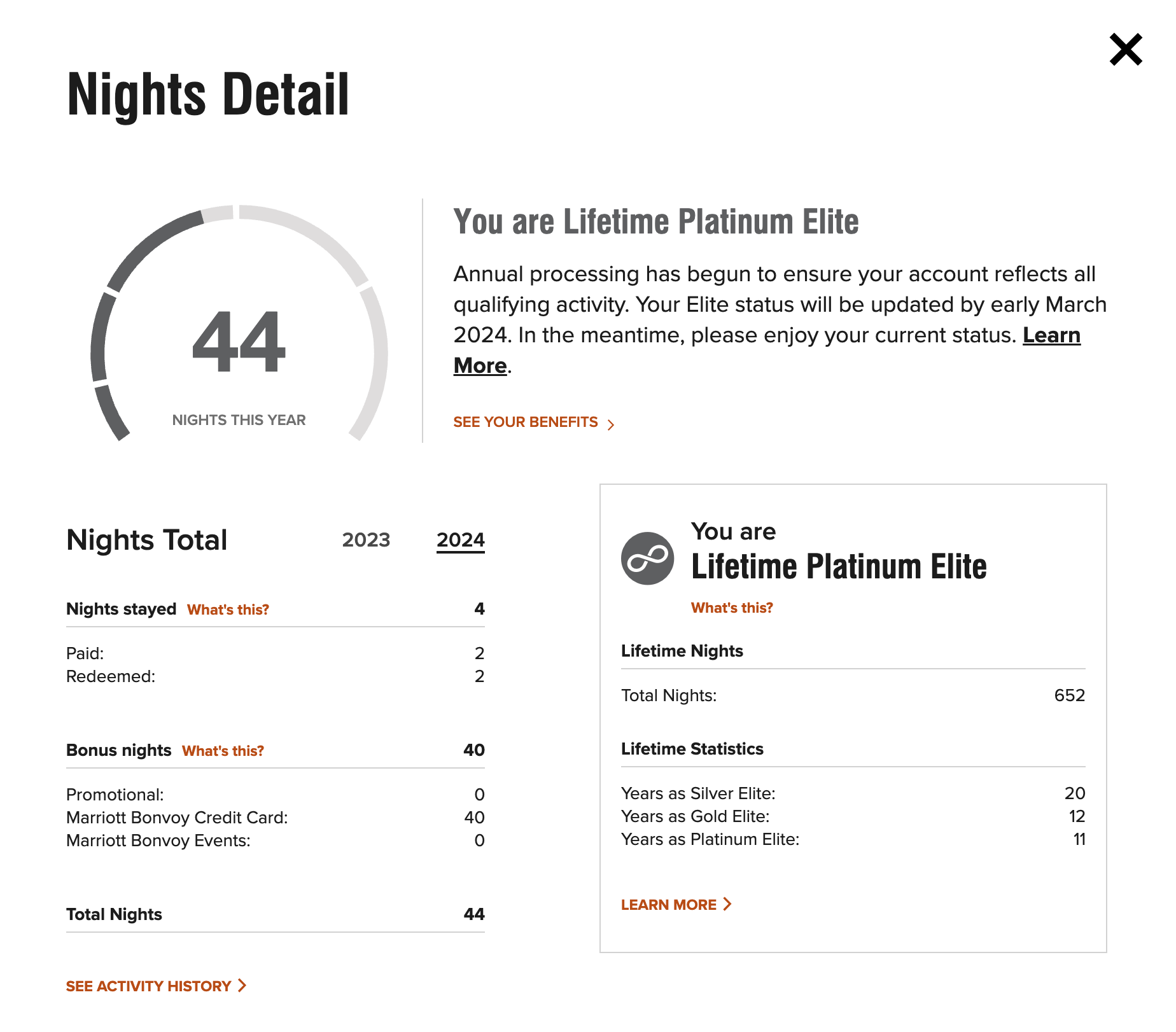

That said, the 25 elite night credits you earn on the Bonvoy Brilliant can be stacked with the 15 elite nights you’ll get with the Bonvoy Business card, allowing you to start each year with 40 elite night credits. TPG senior editorial director Nick Ewen utilized this option and had only stayed four nights at Marriott properties in 2024.

That’s 80% of what you need to earn your first Choice Benefit selection (at 50 nights) and more than halfway to the 75 nights required for Titanium Elite status. Reaching Titanium unlocks another Choice Benefit along with added perks like the ability to be upgraded to standard suites at Ritz-Carlton properties.

Annual award nights

But why stop at two Marriott cards?

There are several reasons to have as many Marriott credit cards as you can get your hands on. This is because of the incredible value you can get from the anniversary award night certificates. Both the Bonvoy Boundless and Bonvoy Business cards offer an anniversary reward night worth up to 35,000 points. However, the premium Marriott Bonvoy Brilliant — with its $650 annual fee (see rates and fees) — offers an annual award night worth up to 85,000 points per night. Certain hotels have resort fees.

Based on TPG’s April 2025 valuations, Marriott points are worth 0.7 cents each, meaning 35,000 points are worth $245.

Still, depending on how you travel, you might be able to get an even higher return on these award nights. A former TPG staffer used theirs at the Sheraton Grand Hyde Park in Sydney, where they were upgraded to a massive terrace suite during peak travel season, and at The St. Regis Beijing for a room that would have cost well over $300 per night.

With Marriott’s dynamic pricing, the ability to use these awards is less predictable than in the past. However, it’s still possible to redeem these awards for more than the cost of your credit card’s annual fee, meaning this one benefit alone can justify keeping your Marriott credit cards year after year.

There are two exceptions here. The Marriott Bonvoy Bevy™ American Express® Card and Marriott Bonvoy Bountiful Card do not offer free night awards automatically each year. On both cards, you would need to make $15,000 in purchases each year to receive a free night award worth up to 50,000 points. Note that certain hotels have mandatory resort charges.

The information for the Marriott Bonvoy Bountiful Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Spending category bonuses

Aside from annual award nights and elite night credits, having a personal and business Marriott card can help you earn more points across several spending categories. All four Marriott cards earn 2 points per dollar spent on everyday spending and 6 points per dollar spent at hotels participating in the Marriott Bonvoy program (with the exception of the no-annual-fee Marriott Bonvoy Bold® Credit Card (see rates and fees); see details below.

Related: Which Marriott Bonvoy credit card is right for you?

But it’s the other bonus categories, most of which do not overlap, that can help you maximize your earnings:

- Marriott Bonvoy Bevy American Express Card: Earn 4 points per dollar spent on the first $15,000 of combined purchases at restaurants worldwide and U.S. supermarkets each calendar year (then 2 points per dollar after that). The Bonvoy Bevy Amex features an annual fee of $250 (see rates and fees).

- Marriott Bonvoy Bold Credit Card: Earn 2 points per dollar spent at grocery stores, ride-hailing services, select food delivery, select streaming, internet, cable and phone services and 1 point per dollar spent on all other purchases.

- Marriott Bonvoy Boundless Credit Card: Earn 3 points per dollar spent on the first $6,000 spent in combined purchases each year at gas stations, grocery stores and dining (then 2 points per dollar spent after that).

- Marriott Bonvoy Bountiful Card: Earn 4 points per dollar spent on the first $15,000 in combined purchases on grocery stores and dining each year (then 2 points per dollar spent after that).

- Marriott Bonvoy Brilliant American Express Card: Earn 3 points per dollar spent on dining at restaurants worldwide and on flights booked directly with airlines. The Bonvoy Brilliant Amex features a $650 annual fee (see rates and fees).

- Marriott Bonvoy Business American Express Card: Earn 4 points per dollar spent on purchases at restaurants worldwide, U.S. gas stations, wireless telephone services purchased directly from U.S. service providers and U.S. shipping purchases. The Bonvoy Business Amex features an annual fee of $125 (see rates and fees).

So, if you’re a big Marriott fan and want to focus your earning strategy solely on Bonvoy points, you can have multiple cards and enjoy earning rates across several categories.

Related: Are you eligible for a new Marriott Bonvoy card? This chart tells you yes or no

Bottom line

Marriott has made it much easier to qualify for elite status by allowing customers with both personal and business credit cards to earn two sets of elite night credits each year. In fact, many TPG staffers kicked off 2024 with 40 elite night credits. When you add this to the annual award night certificates on these credit cards, it’s practically a no-brainer to hold both a personal and business card in your wallet.

Apply here: Marriott Bonvoy Bevy American Express Card

Apply here: Marriott Bonvoy Bold Credit Card

Apply here: Marriott Bonvoy Boundless Credit Card

Apply here: Marriott Bonvoy Brilliant American Express Card

Apply here: Marriott Bonvoy Business American Express Card

For rates and fees of the Marriott Bonvoy Brilliant Amex, click here.

For rates and fees of the Marriott Bonvoy Bevy Amex, click here.

For rates and fees of the Marriott Bonvoy Business Amex, click here.