As you may have seen, Chase recently told us that the best Chase Sapphire Preferred® Card (see rates and fees) offer we’ve seen in four years is ending soon.

With 100,000 Ultimate Rewards bonus points on the line — and no way to know if Chase will take another four-year break (or longer?!) before they roll out an offer this big from the “Chase vault” — we don’t want anyone to accidentally mess this opportunity up.

Offer alert: Earn 100,000 bonus Chase Ultimate Rewards Points after spending $5,000 within three months from account opening with this limited-time offer on the Chase Sapphire Preferred.

Based on the many emails and comments on our social posts about this rare and valuable 100,000-point offer, we’ve picked up on a few themes where would-be-Sapphire Preferred cardholders have some great questions … or, in some cases, unfortunate mistake stories.

While there are some mistakes we unfortunately can’t erase, we can hopefully spread the word about those you can avoid to increase your approval odds.

Related: Is the limited-time 100,000-point Chase Sapphire Preferred offer really one of the best deals ever?

Applying for a Chase Sapphire Preferred with a Chase Sapphire Reserve open

Unfortunately, Chase is pretty darn strict that you can only have one ‘flavor’ of a Sapphire card open at a time.

That means if you are currently a primary cardholder with an open Chase Sapphire Reserve® (see rates and fees), you wouldn’t be eligible for a Chase Sapphire Preferred. This also applies to those who may have downgraded their card to a no-annual-fee Sapphire card, too.

Note that calling Chase to change your product from Chase Sapphire Reserve to Preferred will not trigger eligibility for the bonus. You have to apply from scratch for the Chase Sapphire Preferred and get approved to be considered for the offer with the 100,000 bonus points.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Pro tip: Downgrade to a card in the Chase Freedom family if you don’t want to fully close your account and want to get a Sapphire Preferred or Reserve again at some point in the future.

The information for the Chase Sapphire has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Who’s eligible for the Chase Sapphire Preferred’s 100,000-point bonus?

Thinking you aren’t eligible because you’re a Chase Sapphire authorized user

While you can only have one Sapphire card open as the primary account holder, being an authorized user on a Chase Sapphire Reserve or Preferred should not otherwise stop you from opening an account (with the bonus!) and getting the card under your own name.

Not waiting 48 months from when you last earned a Sapphire welcome bonus

The terms state that “previous cardmembers of any Sapphire credit card who received a new cardmember bonus within the last 48 months” are not eligible for the welcome bonus. And note that it says it is 48 months from receiving a new cardmember bonus, not 48 months from opening a Sapphire account.

First, if you aren’t sure when you had a Sapphire card in the past, you can look at your credit report to see when you opened it. But that’s not the date you should use for the 48-month clock.

On your online Chase account, you can see up to seven years of statements. Once you’ve narrowed down when you opened the card, take a look at your statements around that time frame to check when your bonus actually hit.

Keep in mind that if you think you took close to the full three months to earn the bonus, the bonus points may not have come through for a few months after the fact.

Once you’ve found your magic month, be sure you’re 48 months removed.

This also means that if you got a Sapphire Preferred the last time it had a 100,000-point welcome bonus in the summer of 2021, it almost certainly has not been 48 months since you earned that welcome bonus.

The infamous Chase 5/24 rule

Chase has an unwritten but very real rule that you can’t have opened more than five credit accounts across all banks within the last 24 months and get a sixth (or more) new account from them. Some accounts — such as those opened by your small business — may not count against this total, but otherwise, this is a pretty hard and fast rule.

If you are denied for too many recent new accounts and think you are under 5/24, you can call Chase and see if they’ll flip the no to a yes, especially if you have some accounts where you’ve been added as an authorized user versus the primary account holder.

Related: Your guide to calling a credit card reconsideration line

Not having a deep enough credit history

While a credit score in the 700s is believed necessary to get approved for the Chase Sapphire Preferred, it’s possible that the score alone doesn’t make opening the card a slam-dunk.

We have heard from a number of TPG readers who were not approved for this offer despite stating they have “high credit scores.” What this can sometimes mean is that the applicant doesn’t have a demonstrated history on their own credit report of managing a mix of accounts or a certain number of revolving card accounts.

Whether it is because you are young and starting out, or have just had accounts primarily in a partner’s name while you’ve been an authorized user, this can be a hurdle to getting some really good rewards cards. There’s no overnight fix for a denial for this reason, but we recommend building up your credit with a card or two in your name so you’ll be ready in the future.

Related: The 6 best starter cards for building your credit

Miscalculating spending for the welcome bonus

To earn the 100,000 bonus points, you need to spend $5,000 on the card in eligible purchases in the first three months. Given how valuable those 100,000 points are, you do not want to mess this one up.

First, know that the $95 annual fee does not count toward that spending. Second, I almost messed up earning a welcome bonus before, as I paid for some things with Venmo attached to the card, which did not count as a “cash equivalent”.

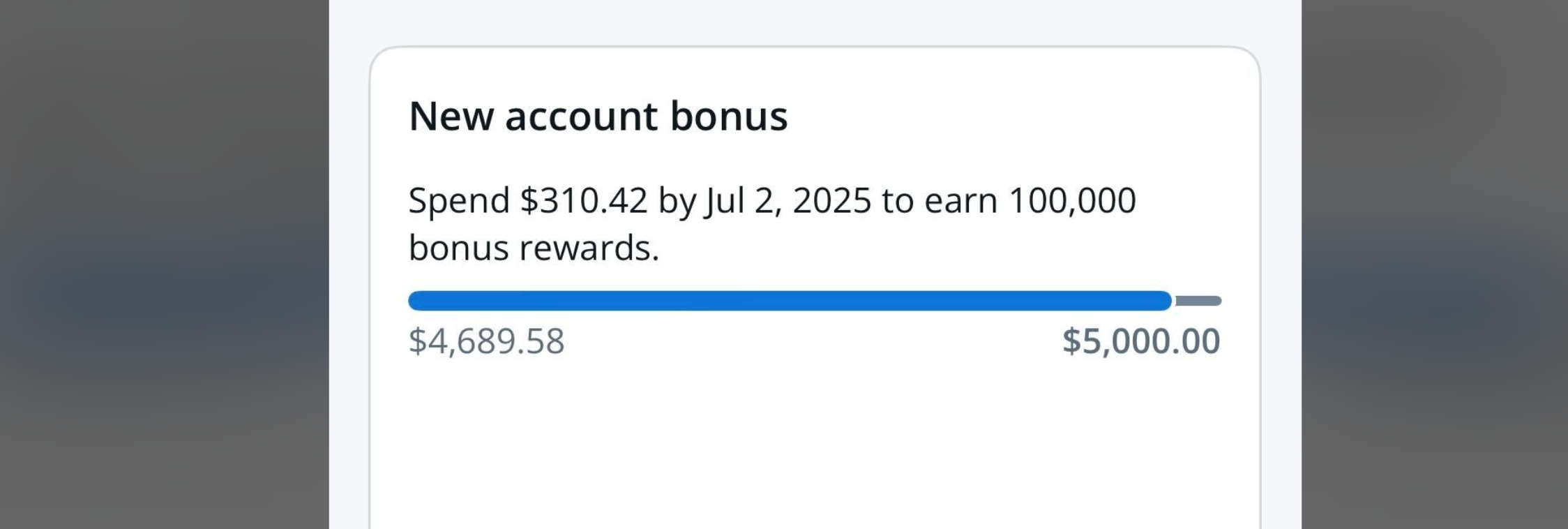

You can monitor your progress by going to the spending tracker in the “benefits and travel” section of your Chase online account, selecting rewards, selecting Chase Sapphire Preferred and scrolling down.

In the Chase app, you should be able to select Chase Sapphire Preferred and then scroll down.

I also recommend against waiting until the very end of the three months to cross that threshold, as purchases need to post to the account in those three months to count.

So if you ordered something online with only a day or two to go, but then it didn’t charge your card until the order shipped four or five days later, you’d be left without the 100,000 bonus points if you needed that purchase to get you over the $5,000 threshold.

If meeting that spending requirement will require some effort, here’s a refresher on everyday things you can charge to credit cards to help you meet it (and beyond).

Pro tip: Car and homeowners insurance are a big help towards spending bonuses in my house.

Related: 9 things you didn’t know you could pay for with a credit card

Forgetting to unlock your credit report

When you apply, Chase will obviously pull your credit report before deciding whether to issue you a new account. So, if you often freeze your credit report, you will want to make sure you have unlocked it for Chase to be able to access it.

Some anecdotal reports suggest Chase often looks at the credit bureau Experian — though it could vary. Regardless, while there may be solutions if you forget to unlock your credit report before applying, it’s much easier to remember to do that step.

Missing out on the best offer in years

Last but not least … don’t make the mistake of waiting too long and missing out on the best offer on this card in almost four years. We don’t know exactly when it is ending, but we do know Chase has said it is “ending soon,” and since they would know best of all — I’d say believe them and act accordingly.

I remember in 2021, when this offer was last around, some folks waited until the last minute to apply. Then life happened, and they ultimately missed out.

Right after it ended, I got many emails and questions about when it would come back or if there was anything they could do, and the answer is once it’s over, it’s over.

If you want it, think you’re eligible and can hit the spending requirement, Chase has officially told us the offer is ending soon, so plan accordingly.

Bottom Line

These are the most common mistakes we’ve come across from those wanting to apply to the Chase Sapphire Preferred and earn the 100,000 bonus.

It comes down to this: Check when you last received a welcome bonus on a Sapphire card, downgrade if you currently have a Sapphire product, make sure you’re under 5/24, unfreeze your credit report, spend accordingly and don’t miss out on the best offer in four years.

And remember, the offer is ending soon, so don’t delay on applying.

Apply here: Chase Sapphire Preferred