Marriott Bonvoy Brilliant American Express Card overview

The Marriott Bonvoy Brilliant® American Express® Card is Marriott’s most premium card offering. Standout benefits include automatic Platinum Elite status, an annual free night certificate and up to $300 in statement credits each year when you use your card at eligible restaurants worldwide. Card rating*: ⭐⭐⭐½

*Card rating is based on the opinion of TPG’s editors and is not influenced by the card issuer.

Marriott has six cobranded cards available to new cardholders at a broad range of added benefits and annual fee levels.

The Bonvoy Brilliant is the most expensive to hold, with its $650 annual fee (see rates and fees). But does that necessarily mean it’s the best?

A credit score of 670 or higher is recommended to be approved for this card.

Let’s dig deeper into the card’s details to help you determine if it’s right for you.

Bonvoy Brilliant Amex pros and cons

| Pros | Cons |

|---|---|

|

|

Bonvoy Brilliant Amex welcome offer

For a limited time, new Marriott Bonvoy Brilliant Amex applicants can earn 185,000 bonus points after spending $6,000 in purchases within the first six months of card membership.

Based on TPG’s March 2025 valuations of Marriott points at 0.7 cents each, those 185,000 points are worth $1,295.

Since this offer comes in at well over 100,000 bonus points, it meets our recommended threshold to apply.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

This is the highest welcome offer we have seen on the Brilliant for a simple spending requirement on the card. The alternative best-ever offer was for 150,000 bonus points after spending $6,000 in the first three months of card membership, plus 50,000 bonus points after staying six eligible paid nights with Marriott (offer no longer available).

This current offer gives you double the time to meet the spending requirement and offers more points for meeting that threshold — and you won’t have to complete any Marriott stays to earn the bonus.

Remember that Amex has restrictions limiting your ability to collect a new welcome bonus if you’ve had similar Marriott products from Chase or previous Starwood Preferred Guest cards from American Express. Be sure to review the card’s offer details page to ensure you’re eligible.

Related: Is the Marriott Bonvoy Brilliant Amex worth the $650 annual fee?

Bonvoy Brilliant Amex benefits

Where the Bonvoy Brilliant Amex shines the most is in the perks it offers (enrollment is required for select benefits; terms apply). These include:

- Annual free-night award: Each year after your card renewal month, you’ll receive a free night award at participating hotels worth up to 85,000 points. That’s much more valuable than the free night certificates that come with some lower-tier Marriott cards, which are capped at 35,000 points. Some of the best uses of the certificate include luxury hotels such as The Ritz-Carlton, Berlin and The St. Regis Langkawi, where rooms routinely top $500 per night — though Marriott’s dynamic pricing may impact your ability to book some of these properties. (Certain hotels have resort fees.)

- Marriott Platinum Elite status: Primary cardmembers receive complimentary automatic Marriott Platinum Elite status, which includes perks like upgrades to suites, 4 p.m. late checkout (subject to availability) and lounge access. You should receive your upgraded status in less than two weeks.

- Up to $300 in restaurant credits: As a cardmember, you’ll receive up to $25 in statement credits each month when you use your card at eligible restaurants worldwide, equating to a total value of up to $300 each calendar year. (A spokesperson for American Express has confirmed that this credit applies to worldwide restaurants, is automatically applied and does not require registration prior to using this benefit.)

- Property credit of up to $100: When you book direct using a special rate for a stay of at least two nights at Ritz-Carlton or St. Regis properties with your card, you’ll receive a credit of up to $100 for incidentals.

- Priority Pass lounge access: As is pretty standard among premium travel rewards cards, the card comes with a Priority Pass Select membership, which gives you and up to two guests unlimited access to more than 1,700 airport lounges worldwide. Additional guests are charged the visit fee (enrollment is required). This membership does not include access to Priority Pass restaurants.

- Application fee credit for Global Entry or TSA PreCheck: Like many other premium cards, the Bonvoy Brilliant will reimburse you via statement credit when you charge the application fee for Global Entry or TSA PreCheck to the card up to $120 (up to $85 once every 4½ years for TSA PreCheck or $120 once every four years for Global Entry). If you already have Global Entry or PreCheck, you can use this credit to cover a loved one’s application fee. Remember, Global Entry includes TSA PreCheck, so it’s typically the better choice.

- Elite night credits: Cardmembers will receive 25 elite night credits annually. This benefit can be stacked with the nights you earn with a Marriott small-business card. When you combine the elite night credits you earn on the Brilliant with those earned on a Marriott business card, you’ll reach 40 elite nights each year without any stays.

- Annual Earned Choice Award: You’ll receive an earned choice award after making $60,000 in eligible purchases in a calendar year. This is separate from the Choice Benefits you’d unlock by reaching 50 and 75 elite-qualifying nights. You can only earn one Earned Choice Award per calendar year, and you can choose from the following: five Nightly Upgrade Awards, an 85,000-point free night reward or $1,000 off a mattress or box spring from any Marriott Bonvoy retail brand.

- Shopping protections: Purchases made with the card can get up to one year of extended warranty coverage* and 90 days of purchase protection.*

- Travel protections: The Marriott Bonvoy Brilliant Amex offers trip cancellation and interruption insurance** and trip delay insurance** for trips delayed by more than six hours due to a covered reason. To be covered, you must book a round-trip ticket and pay entirely with your card.

Those who can maximize the full value of the Bonvoy Brilliant Amex’s benefits will easily justify the card’s hefty annual fee.

*Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

**Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

Related: How to use the Marriott Bonvoy Brilliant’s $25 monthly dining credit

Earning points on the Bonvoy Brilliant Amex

Bonvoy Brilliant Amex cardmembers earn Marriott Bonvoy points at the following rates:

- 6 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program

- 3 points per dollar at restaurants worldwide

- 3 points per dollar on flights booked directly with airlines

- 2 points per dollar on other eligible purchases

The non-Marriott earning rates are a bit low, so you’ll probably want to pair the card with one or more other cards that offer superior bonus categories, such as The Platinum Card® from American Express for flights and the Chase Sapphire Reserve® for dining and other travel purchases.

There are also some other great options for your everyday spending that would make a solid pairing with the Bonvoy Brilliant.

Related: The best credit card pairings

Redeeming points on the Bonvoy Brilliant Amex

The most obvious and valuable way to redeem the Marriott Rewards points you’ll earn on the Bonvoy Brilliant Amex is for stays at Marriott properties.

However, what’s important to note with the Marriott Bonvoy program is its dynamic award pricing. This means that the number of points you’ll need to book rooms at any property could vary month-to-month (even day-to-day) depending on demand.

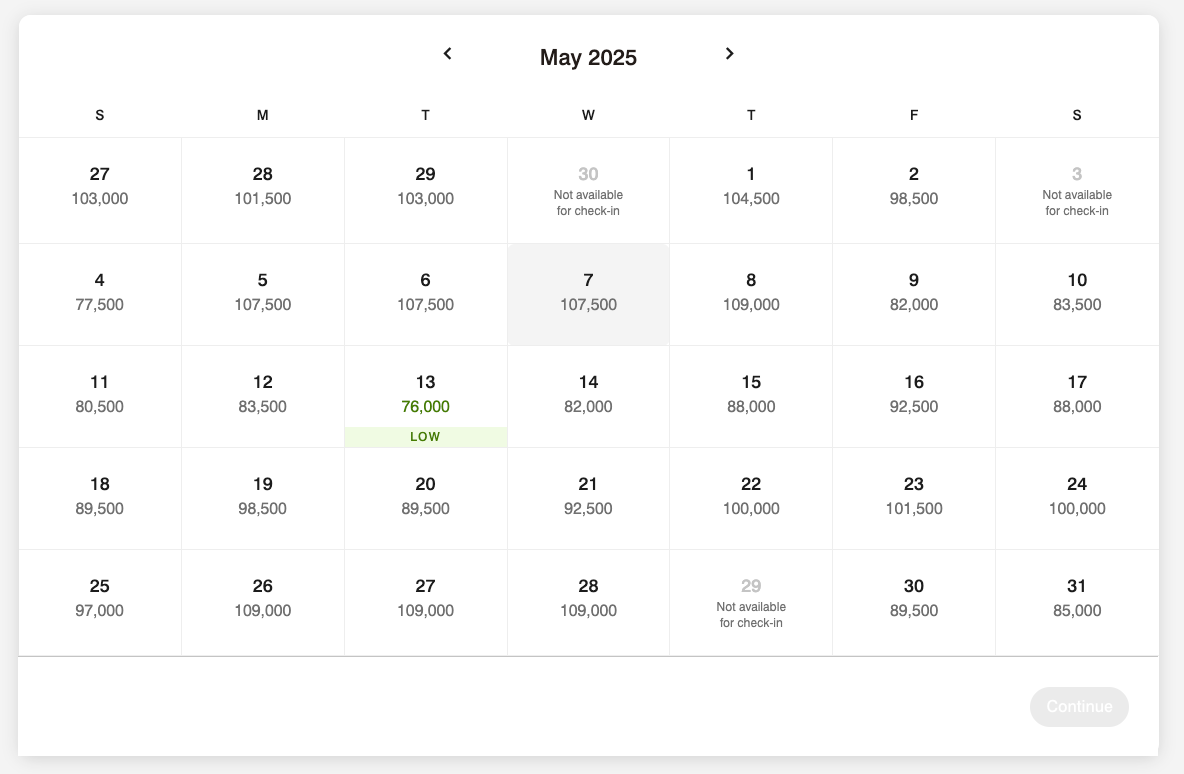

For instance, if you’re searching for award prices at the Wailea Beach Resort by Marriott in May 2025, you could pay as low under 80,000 points one night and almost 110,000 on another.

The rate you lock in will depend on your flexibility. It’s notable that Marriott Bonvoy has also devalued its points in recent months. On average, you’ll need more points to book rooms now than you would’ve before these changes took effect.

However, with the ability to book 10,000 global destinations across more than 30 hotel brands, you’ve got a lot of choices. Marriott Bonvoy boasts many fantastic hotels, including some of the world’s most luxurious properties.

Some of the more luxurious hotels and resorts you could book with Marriott Bonvoy points include a number of Ritz-Carlton and St. Regis properties. Some are all-suite, such as the St. Regis Maldives, and others are in dreamy destinations like the Al Maha Resort in the desert outside Dubai.

Rooms at top-tier properties like these typically cost 100,000 points (or even more) per night. That may seem like a hefty price in points, but it isn’t a bad value considering that these room rates can reach $1,500 per night most of the year.

TPG credit cards writer Chris Nelson received outstanding value by redeeming four nights at the JW Marriott Sao Paulo during peak season for 120,000 points.

Related: Maximizing redemptions with the Marriott Bonvoy program

Transferring points on the Bonvoy Brilliant Amex

In addition to redeeming them for stays at Marriott Bonvoy properties, you can transfer your Bonvoy points to more than 35 airline partners.

However, this rarely offers good value, so we recommend avoiding it unless you need to top off an account balance for a flight redemption or need to access an airline’s loyalty currency.

Related: When does it make sense to transfer Marriott points to airlines?

Which cards compete with the Bonvoy Brilliant Amex?

If you’re not loyal to Marriott, there are a number of cards you might consider instead of the Bonvoy Brilliant Amex:

For additional options, check out our full list of the best hotel credit cards.

Related: The best premium credit cards: A side-by-side comparison

The information for the Hilton Honors Aspire Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

If you’re a Marriott loyalist in need of a cobranded credit card or are looking to change from a different Marriott card, the Marriott Bonvoy Brilliant Amex is an ideal choice.

Its earning rates are not as lucrative as those of some of its competitors. However, the valuable welcome bonus coupled with impressive built-in perks — like up to $300 in restaurant credits each calendar year and an annual free-night certificate of up to 85,000 points — make it easy for Marriott loyalists to get tremendous value out of the card.

Apply here: Marriott Bonvoy Brilliant

Related: Which credit card should you use for Marriott stays?

For rates and fees of the Marriott Bonvoy Brilliant Amex, click here.

For rates and fees of the Marriott Bonvoy Bevy Amex, click here.